Bitcoin’s record rally topped $107,000 after United States President-elect Donald Trump reiterated that he plans to create a US Bitcoin strategic reserve similar to the country’s strategic oil reserve, stoking the enthusiasm of crypto bulls.

Bitcoin, the world’s biggest and best-known cryptocurrency, extended gains to a session high of $107,148 and was most recently at $106,877, up 5.43 percent from late Friday. The number two digital currency, Ethereum or Ether, was up 1.85 percent at $3,975.70.

“We’re in blue sky territory here,” said Tony Sycamore, an analyst at IG, an online trading provider. “The next figure the market will be looking for is $110,000. The pullback that a lot of people were waiting for just didn’t happen, because now we’ve got this news.”

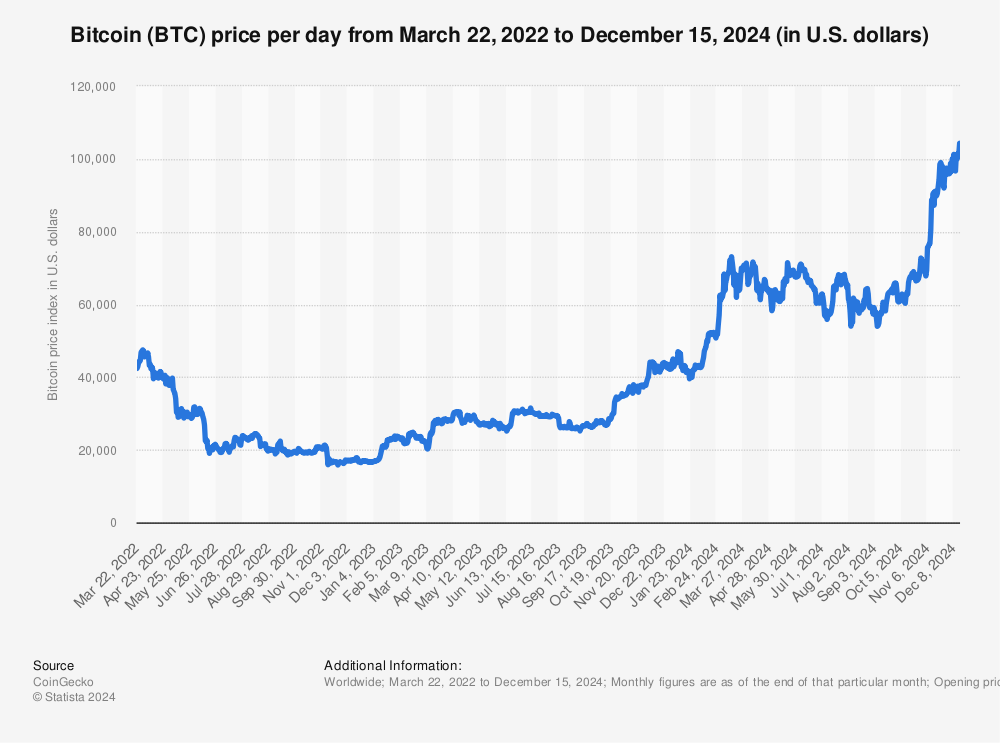

Bitcoin and crypto have been catapulted into the spotlight as investors wager the incoming Trump administration will usher in a friendlier regulatory environment, boosting sentiment around the alternative currency. Bitcoin is up about 150 percent in 2024.

“We’re gonna do something great with crypto because we don’t want China or anybody else – not just China but others are embracing it – and we want to be the head,” Trump told CNBC late last week.

When asked if he plans to build a crypto reserve similar to oil reserves, Trump said: “Yeah, I think so.” He advocated the same move earlier this year.

Governments around the world held 2.2 percent of Bitcoin’s total supply as of July, according to data provider CoinGecko, with the US possessing nearly 200,000 Bitcoins valued at more than $20bn at current levels.

China, the United Kingdom, Bhutan and El Salvador are the other countries with a significant amount of Bitcoins, data site Bitcoin Treasuries showed.

Other nations have also been considering cryptocurrency strategic reserves.

Russian President Vladimir Putin said earlier this month that many countries were turning to alternative assets, including cryptocurrencies.

“For example, Bitcoin, who can prohibit it? No one,” Putin said.

There are sceptics, though, with Federal Reserve Chair Jerome Powell likening Bitcoin to gold earlier this month. Analysts also point out that any such move will take time to implement.

“I think we still need to be cautious on a BTC strategic reserve, and at least consider that this is not likely to happen anytime soon,” said Chris Weston, head of research at Pepperstone, a trading platform.

“Of course, any comment from Trump that offers an increased degree of hope that plans for a strategic reserve are evolving is an obvious tailwind, but this would come with consequences which would need to be carefully considered and well telegraphed to market players,” he said.

Crypto boost

Bitcoin has surged more than 50 percent since the November 5 US vote that saw Trump elected to office along with many other pro-crypto candidates. The total value of the cryptocurrency market has almost doubled over the year so far to hit a record over $3.8 trillion, according to CoinGecko.

Trump – who once labeled crypto a scam – embraced digital assets during his campaign, promising to make the US the “crypto capital of the planet”.

Trump this month named a White House czar for AI and cryptocurrencies, former PayPal executive David Sacks, a close friend of Trump adviser and megadonor Elon Musk.

Trump also said he would nominate pro-crypto Washington attorney Paul Atkins to head the Securities and Exchange Commission.

On Friday, exchange operator Nasdaq said MicroStrategy, led by chief executive Michael Saylor, will be added to the Nasdaq-100 Index, with the change coming into effect before the market opens on December 23.

MicroStrategy, an aggressive investor in the world’s largest crypto asset, has seen its shares soar more than sixfold this year, taking its market value to almost $94bn. It is now the largest corporate holder of the cryptocurrency.

“The inclusion seems a bit unexpected, but that hasn’t stopped the excitement of what many believe to be the start of a looping cycle of capital that could potentially drive up the spot Bitcoin price,” said Matthew Dibb, chief investment officer at crypto asset manager Astronaut Capital.

MicroStrategy shares were up 4.2 percent on Monday.